Corporate Business Structuring

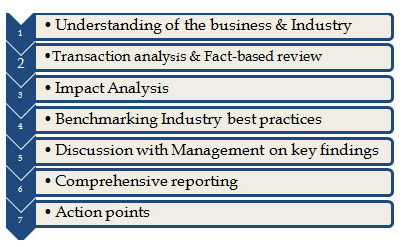

We help client in structuring their business transactions so as to MAXIMISE after tax profit. This is based on analysis of business activities and recommendation of alternatives consistent with business practices and also the applicable laws. In totality the whole aim is not to evade tax but to take maximum advantage of incentives available under the current tax regime and proposed changes if any so as to minimize the tax liability without compromising on expansion plans.

The findings of the Review throw light on the potential risk areas and help the Client devise an appropriate defense and tax-risk mitigation strategy.

Corporate Groups that have presence in multiple Tax Jurisdictions face two challenges - firstly, limiting the overall tax cost to the Group and secondly, managing the Tax function efficiently in accordance with the Group’s Business Strategy. The world over, as the Tax Regulations go through a transformation to track tax avoidance routes; a deep understanding of such issues become pivotal before investment initiatives are planned for different markets. Also, with regard to structuring of income and/or transactions, it is imperative to understand the tax consequences of the proposed transactions in advance. PRAJCO’s focused approach in following tax developments in key Tax Jurisdictions enables it to provide expert advice to its Indian Clients keeping in view the overall tax and business implications in these Jurisdictions. PRAJCO counsels Clients in developing inbound as well as outbound investment structures which result in tax efficiency during the duration of investment period as also at the time of exit. PRAJCO consultation also encompasses Income structuring, Cash optimisation and Profit extraction Strategy that balances with Transfer Pricing strategy.

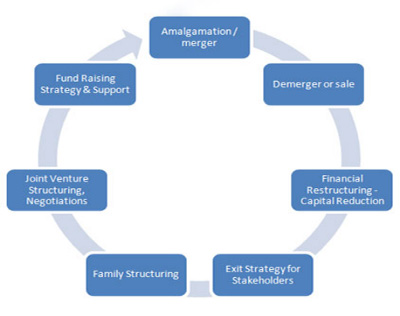

PRAJCO renders the requisite support in terms of advisory, compliance and controversy related services on a host of cross-border tax matters. This involves characterisation of income streams to determine the appropriate levels of taxation, determination of Permanent Establishment exposures and related attribution issues, claiming necessary foreign tax reliefs, etc. Apart from the conceptual value that is based on commercial parameters, the eventual success of a Corporate Restructuring exercise depends upon how timely and efficiently Regulatory challenges under Corporate Law, Direct and Indirect Tax, FIPB, Securities Law, Exchange Control Regulations, Competition Laws, etc are dealt with. PRAJCO advises on Corporate Restructuring that inter alia includes the following:

PRAJCO's Team is confluence of professionals having experience in the streams of Accounting, Tax, Regulatory and Financial practice areas. Some of the corporate restructurings carried out in the past have resulted in a re-alignment of shareholding pattern, bringing cost & tax efficiency within the group entities, making the Company ‘investor-ready’. The Team also helps business houses to develop flexible and efficient corporate structures to meet challenges of an ever-changing commercial and regulatory environment.